vermont sales tax on alcohol

Among the eight surrounding states Vermont and Massachusetts do not apply state sales tax to alcohol sales and New Hampshire has no sales tax. Vermont VT Sales Tax Rates by City.

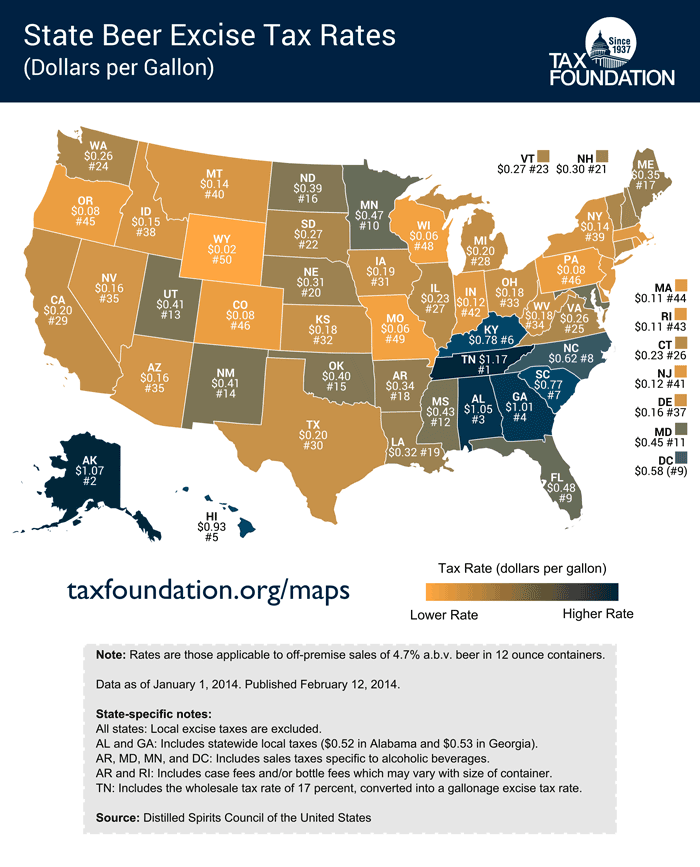

These States Have The Highest And Lowest Alcohol Taxes

You can print a 7 sales tax table here.

. Select the Vermont city from the list of popular cities below to see its current sales tax rate. There are a total of 205 local tax jurisdictions across the state collecting an average local tax of 0093. The 7 sales tax rate in Manchester consists of 6 Vermont state sales tax and 1 Manchester tax.

Vermonts general sales tax of 6 does not apply to the purchase of liquor. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0092 for a total of 6092 when combined with the state sales tax. Vermont Sales and Use Tax The Vermont Sales and Use Tax does not apply to alcoholic beverages sold for immediate consumption.

Beer and wine which are not part of the control system face two types of taxes in Vermont. By imposing the State sales tax the 1 local option sales tax will automatically apply in jurisdictions that have adopted such a tax. Hypothetically if the sales and use tax were applied a free sample would be considered a taxable use of inventory.

Direct Ship to Retail. Vermont has a statewide sales tax rate of 6 which has been in place since 1969. Liquor sales are only permitted in state alcohol stores also called ABC Stores.

Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on. The first is an alcohol sales tax of 10 plus a 1 local option tax in some cities.

Vermont has recent rate changes Fri Jan 01 2021. -88817841970013E-16 lower than the maximum sales tax in VT. See definition at 32 VSA.

That includes Montpelier which like Barre has a 1 tax on rooms meals and alcohol. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities. 90 on sales of prepared and restaurant meals.

The Division of Liquor Control is responsible for the sale of spirits and the enforcement of laws and regulations regarding alcohol and tobacco in Vermont. Vermonts excise tax on Spirits is ranked 15 out of the 50 states. Delivery in Vermont by the holder of a license shall be deemed to constitute a sale in Vermont at the place of delivery and shall be subject to all excise and sales taxes levied by the State of Vermont.

Hemmerick again provided the set up for Herring when he noted hed toured the citys public works complex for the first time and acknowledged reports that it was in really really really. Taxes on spirits are significantly higher than beer and wine at 1350 per gallon while beer is taxed at 18 per barrel and wine is 107-340 per gallon. The Vermonts state tax rate varies depending of the type of purchase.

Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax. Alcoholic Beverage Sales Tax. This means that depending on your location within Vermont the total tax you pay can be significantly higher than the 6 state sales tax.

Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. The second is an excise tax which us 27 cents per gallon of beer and 55. Malt and Vinous Beverage Tax Although no meals and rooms tax is due when a.

90 on sales of lodging and meeting rooms in hotels. When a seller does not charge the buyer Vermont sales tax on an item taxable in Vermont the buyer must pay use tax. Alcohol Beverage Tax.

The maximum local tax rate allowed by Vermont law is 1. Effective June 1 1989. Higher sales tax than 87 of Vermont localities.

All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS. Alcohol sales in Massachusetts were subject to sales tax from August 1 2009 to December 31 2010 but a November 2010 voter referendum repealed that law. Pay directly to the Commissioner of Taxes the amount of tax on the vinousmalt beverages shipped.

100 on sales of alcoholic beverages served in restaurants. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format. This is because spirits have higher alcohol content than the other categories.

If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax. Meals and Rooms Rates in Vermont 90 on sales of prepared and restaurant meals 90 on sales of lodging and meeting rooms in hotels 100 on sales of alcoholic beverages served in restaurants Local Option Tax. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states.

Certain Municipalities may also impose a local option tax on meals and rooms. Certain municipalities may. 20 excise tax and the existing 6 sales tax.

A Vermont Alcohol Tax can only be obtained through an authorized government agency. Meals - 9 alcohol - 10 general goods - 6 rooms - 9. With local taxes the total sales tax rate is between 6000 and 7000.

Vermont has a 6 statewide sales tax rate but also has 205 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0093 on top of the state tax. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Vermont Alcohol Tax. Average Sales Tax With Local.

There is no applicable county tax or special tax. Vermont Liquor Tax 15th highest liquor tax. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax.

The sales tax rate is 6. Municipal advocates voiced a strong preference to authorize a new local taxing authority specific to sales of. Tax Rates for Meals Lodging and Alcohol.

The Office of Education provides education services to licensees bartenders servers store clerks consumers parents teenagers and anyone else who needs to know how to make sure alcohol. Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. For beverages sold by holders of 1st or 3rd class liquor licenses.

The state sales tax rate in Vermont is 6000. While other communities in central Vermont have talked about a sales tax none yet has one.

Everclear Price List Find The Perfect Bottle Of Grain Alcohol 2022 Guide

Is There A Liquor Shortage Looming In Your State

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

The U S Liquor Supply Chain Could Take Years To Recover From Covid 19 Upheaval Npr

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

The Bizarre Thing That Happens When Grocery Stores Can T Sell Booze The Washington Post

Everclear Grain Alcohol 750 Ml Walmart Com

Alcohol Taxes On Beer Wine Spirits Federal State

These States Have The Highest And Lowest Alcohol Taxes

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

Is There A Liquor Shortage Looming In Your State

The First Out On A Limb Chocolate Raspberry Chocolate Raspberry Chocolate Raspberry

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Original Stormtrooper Beer Lightspeed Pilsner Beer Pale Ale Pilsner

Perceptual At Product Category Level Perceptual Map Interesting Questions Alcohol Mixers

Walmart Renews Its Battle To Sell Liquor In Texas Dentonrc Com